What is an Investment-linked Insurance Policy (ILP)?

1. CPF Ordinary Account (2.5%) or Singapore Savings Bonds (7 years - 2.42%)

Simple interest on the gain/profit = 1,315.69 / 13,500 = 9.75%

Difference = (1,315.69 - 176.81) / 176.81 = 644.13%

The interest she can get would be $1,315.69, easily 6 times! Topping up just the OA is not possible, that is why I have also included the Singapore Savings Bonds (SSB). However, SSB has its limitation as well - the minimum investment is $500 and the return varies every month. Investing in SSB monthly is pretty interesting as one will be building up a Bond Ladder to generate a consistent cash flow/passive income very conservatively.

2. CPF Special Account (4.0%)

Simple interest on the gain/profit = 2,169.80 / 13,500 = 16.07%

Difference = (2,169.80 - 176.81) / 176.81 = 1127.19%

The interest she can get would be $2,169.80, easily 11 times and did I mention tax relief too! Of course one may argue that the money is locked up and cannot be withdrawn. That is true to a certain extent but the money is still yours at the end of the day for retirement. Besides, I am just trying to show how bad the ILP returns are.

3. Invest in STI ETF (Dollar Cost Averaging)

Backtesting was quite tedious. I first downloaded all the historical data from Yahoo Finance and research for the most cost-effective regular savings plan. I was choosing between POSB and Maybank (lowest sales charge @ 1% which is the cheapest for investment amount less than $500) but settle for POSB because their FAQs was clearer when I was looking for answers to the fees and breakdown of the investment (no fractional units). You can refer to this article - Which Monthly Investment Plan Is Suitable For You? by Dollars and Sense for more information.

You can refer to my Google Spreadsheet for the results of the backtesting - STI ETF Monthly Regular Savings Backtesting. CZM would be holding 4,315 units of SPDR STI ETF with a total value of $14,325.80 assuming the price of STI ETF is $3.32 and collected a total dividend of $1,939.10.

Simple interest on the gain/profit = 2,764.91 / 13,500 = 20.48%

Difference = (2,764.91 - 176.81) / 176.81 = 1463.77%

The annual rate of return is about 4.995% as compared to the miserable 0.351% >.< In my backtesting, I did not reinvest the dividends. Otherwise, the return would have been easily higher than 5%!

Update on 2017-08-04: A reader has pointed out that one can only invest in NIKKO STI ETF using POSB RSP which I have missed! I have updated the spreadsheet to show the backtesting results for both STI ETF.

Simple interest on the gain/profit = 2,497.78 / 13,500 = 18.50%

Difference = (2,497.78 - 176.81) / 176.81 = 1312.69%

4. Active Investing in Stocks

Not a good idea if you have no/little knowledge. KPO not going to backtest this as I have no idea how to do it. Imagine if you pick one of the STI components back in 2010 - Noble Group Limited! GG!

Why is the ILP return so low? There are a couple of reasons, first look at what is the underlying "investment" being made:

Notice how large/wide the spread of the bid and offer price is? You buy at $1.627 but sell at $1.572. The moment you buy, you already lost 3.38% ((1.627 - 1.572) / 1.627) of your capital.

Next, we look at what are the "investments" made by the fund - AIM 2035 Fund.

OMG! Do you see what I am seeing?! Not the sales charge and management charge! Look at the top 10 holdings! They are all funds!!! This is a fund of funds and you simply keep getting charge here and there! How to make money?

Last but not least, do you see the car your agent drive? You paid for it partially. lol. Just kidding (partially). I do have friends that are in this industry and not all agents are evil. My definition of evil is recommending you ILP immediately without finding more about your needs. I encountered and scolded one before - he was supposed to be a family "trusted" agent. I called to ask about a life insurance my grandmother purchased for us and he was trying to sell ILP to me -.-" KPO is very defensive when it comes to $$$.

Another of our friend recommended us ILP when CZM was trying to purchase only a hospitalization plan. I asked him to be honest about the commission and he said he would be getting the commission for the next 7 years.

I did a quick search online and found this article by $1Million Personal Financial Diary - Commission Structure of Insurance Agents REVEALED. His article was written in 2010 (could be outdated) but this should be a good enough gauge/estimate. Do you see the low hanging fruit there for all the agents? 45% commission based on the first year premium!

Morals of the story:

1. Insurance and investment should always be separated! You can never get the best of both worlds, separate your wife and girlfriend(s). lol. I am really kidding this time round.

2. Buy term insurance and invest the rest! Dollar cost averaging STI ETF is always a good starting point especially if one has no time to read up and research on stocks.

3. Never ever buy ILP!

Investment-linked insurance policies (ILPs) have both life insurance and investment components. Your premiums are used to pay for units in investment–linked sub-fund(s) of your choice. Some of the units you buy are then sold to pay for insurance and other charges, while the rest remain invested.

The above definition is taken from MoneySense, you can find out more here. Interestingly, if you try to google "ILP", this will be the search result and I highly recommend that you read it - The Ugly Truths Behind Investment-Linked Policies by Dollars and Sense.

Unfortunately, CZM was a victim too. She purchased it when she was young and naive at the age of 19 introduced by the family "trusted" agent. Fast forward 7.5 years later, she finally saw her "investment" break even... I will not explain or go into the details why ILP is a scam bad (KPO cannot be so extreme) instead I will just show you the numbers (read the article by Dollars and Sense for the details/reasonings).

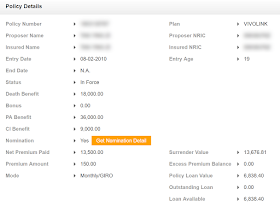

CZM started the policy in February 2010 with a monthly GIRO of $150. Till date, the total premium paid is $13,500 and the surrender value is $13,676.81.

Total number of payments: 13,500 / 150 = 90 months (7.5 years)

Investment gain/profit: 13,676.81 - 13,500 = $176.81

Simple interest on the gain/profit = 176.81 / 13,500 = 1.31%

However, using an investment calculator, one will be able to calculate the annual rate of return which is 0.351% in this case. If you are thinking "not too bad what, better interest than banks", people dun invest to beat bank interest and that is way lower than inflation (which means you become poorer over time)!

As you can see from the above graph on Singapore core inflation rate taken from TradingEconomics, the average rate of inflation has been between 1% - 2%. What could CZM have done to beat the above return?

As you can see from the above graph on Singapore core inflation rate taken from TradingEconomics, the average rate of inflation has been between 1% - 2%. What could CZM have done to beat the above return?

1. CPF Ordinary Account (2.5%) or Singapore Savings Bonds (7 years - 2.42%)

Simple interest on the gain/profit = 1,315.69 / 13,500 = 9.75%

Difference = (1,315.69 - 176.81) / 176.81 = 644.13%

The interest she can get would be $1,315.69, easily 6 times! Topping up just the OA is not possible, that is why I have also included the Singapore Savings Bonds (SSB). However, SSB has its limitation as well - the minimum investment is $500 and the return varies every month. Investing in SSB monthly is pretty interesting as one will be building up a Bond Ladder to generate a consistent cash flow/passive income very conservatively.

2. CPF Special Account (4.0%)

Simple interest on the gain/profit = 2,169.80 / 13,500 = 16.07%

Difference = (2,169.80 - 176.81) / 176.81 = 1127.19%

The interest she can get would be $2,169.80, easily 11 times and did I mention tax relief too! Of course one may argue that the money is locked up and cannot be withdrawn. That is true to a certain extent but the money is still yours at the end of the day for retirement. Besides, I am just trying to show how bad the ILP returns are.

3. Invest in STI ETF (Dollar Cost Averaging)

Backtesting was quite tedious. I first downloaded all the historical data from Yahoo Finance and research for the most cost-effective regular savings plan. I was choosing between POSB and Maybank (lowest sales charge @ 1% which is the cheapest for investment amount less than $500) but settle for POSB because their FAQs was clearer when I was looking for answers to the fees and breakdown of the investment (no fractional units). You can refer to this article - Which Monthly Investment Plan Is Suitable For You? by Dollars and Sense for more information.

You can refer to my Google Spreadsheet for the results of the backtesting - STI ETF Monthly Regular Savings Backtesting. CZM would be holding 4,315 units of SPDR STI ETF with a total value of $14,325.80 assuming the price of STI ETF is $3.32 and collected a total dividend of $1,939.10.

Simple interest on the gain/profit = 2,764.91 / 13,500 = 20.48%

Difference = (2,764.91 - 176.81) / 176.81 = 1463.77%

The annual rate of return is about 4.995% as compared to the miserable 0.351% >.< In my backtesting, I did not reinvest the dividends. Otherwise, the return would have been easily higher than 5%!

Update on 2017-08-04: A reader has pointed out that one can only invest in NIKKO STI ETF using POSB RSP which I have missed! I have updated the spreadsheet to show the backtesting results for both STI ETF.

Simple interest on the gain/profit = 2,497.78 / 13,500 = 18.50%

Difference = (2,497.78 - 176.81) / 176.81 = 1312.69%

One would have 4,285 units of NIKKO STI ETF and collected a total dividend of $1,343.08. The annual rate of return is about 4.553%.

4. Active Investing in Stocks

Not a good idea if you have no/little knowledge. KPO not going to backtest this as I have no idea how to do it. Imagine if you pick one of the STI components back in 2010 - Noble Group Limited! GG!

Why is the ILP return so low? There are a couple of reasons, first look at what is the underlying "investment" being made:

Notice how large/wide the spread of the bid and offer price is? You buy at $1.627 but sell at $1.572. The moment you buy, you already lost 3.38% ((1.627 - 1.572) / 1.627) of your capital.

Next, we look at what are the "investments" made by the fund - AIM 2035 Fund.

OMG! Do you see what I am seeing?! Not the sales charge and management charge! Look at the top 10 holdings! They are all funds!!! This is a fund of funds and you simply keep getting charge here and there! How to make money?

Last but not least, do you see the car your agent drive? You paid for it partially. lol. Just kidding (partially). I do have friends that are in this industry and not all agents are evil. My definition of evil is recommending you ILP immediately without finding more about your needs. I encountered and scolded one before - he was supposed to be a family "trusted" agent. I called to ask about a life insurance my grandmother purchased for us and he was trying to sell ILP to me -.-" KPO is very defensive when it comes to $$$.

Another of our friend recommended us ILP when CZM was trying to purchase only a hospitalization plan. I asked him to be honest about the commission and he said he would be getting the commission for the next 7 years.

|

| Taken from $1Million Personal Financial Diary |

I did a quick search online and found this article by $1Million Personal Financial Diary - Commission Structure of Insurance Agents REVEALED. His article was written in 2010 (could be outdated) but this should be a good enough gauge/estimate. Do you see the low hanging fruit there for all the agents? 45% commission based on the first year premium!

Morals of the story:

1. Insurance and investment should always be separated! You can never get the best of both worlds, separate your wife and girlfriend(s). lol. I am really kidding this time round.

2. Buy term insurance and invest the rest! Dollar cost averaging STI ETF is always a good starting point especially if one has no time to read up and research on stocks.

3. Never ever buy ILP!

Objectively though, it's not a like-for-like comparison being done here. The "return" on the ILP looks terrible at first glance compared to the other investments, but that's after already offsetting the cost of the insurance. If one took the other investments' returns and subtracted say a couple hundred dollars a year for term insurance, the net "returns" would be somewhat similar.

ReplyDeleteI say this having bought ILP, yes, but my agent has done ~5% net long-term returns for most of his clients. And based on his experience, "breaking even" before 7.5 years as illustrated here is actually doing very well; normally at ~5% net returns (just on the invested portions of the premiums) break even takes about 11 years (yes, because ILP costs are front-loaded, but that also means they are really meant for longer term and a higher proportion of the premium goes towards the investment—even >100%—after certain number of years). At the end of the day, I believe it really boils down to how well the agent manages the funds for their clients and whether one is prepared for longer-term investment, and counter-intuitively the author's example is of an account doing quite well, just that it is in its early days, relatively speaking.

Hi b,

DeleteThanks for dropping by and leaving a comment! I agree to a certain extent but I could not replicate it. For example, the ILP that CZM got, the death benefit is $18,000. I cannot find a term insurance with that kind of coverage. It is the same for PA and CI coverage. $9,000 CI coverage got what use? lol.

Furthermore, when ILP is marketed to us, does the agent spend more time explaining the insurance coverage to you or the investment component? ILP is always marketed as an investment product with insurance. Hence, I believe that it is fair that I calculate the return as above too.

Someone shared this article during the same discussion in 1 of the FB group I was in - https://www.ifa.sg/dont-faint-too-many-layers-of-fees-in-investment-linked-policies-ilps/. There are simply too many fees associated with an ILP which will eat into your return and once you lose out in the early days of your years, the compounding effect becomes a lot lesser.

Another person also pointed out in the FB group that ILP was created in the US because investment are taxable there but not for ILP. As much as I can see, there is really no reason to get an ILP here in Singapore. One can easily start a RSP with any bank and invest in STI ETF for really small amount of money.

My question to you would be have you make your own calculation or are you purely taking the word of your agent? Does the idea of breakeven after 11 years of investment sound right at all? I would not even call that an investment anymore. One would have lost 10 years of time for your investment to be compounded >.<

Having said that, I am happy for you if you are indeed getting your 5% annualized return. I am simply hoping that others will learn from our mistakes hence this article serves to warn others that have yet to get an ILP for investment to consider carefully and think twice or even thrice :)

hi KPO,

ReplyDeletehow come your STI ETF excel shows dividends from SPDR? is it just a test?

this is because i thought POSB only sell NIKKO instead of SPDR... as my mthly purchase price seems different from your data...

Hi Edmund,

DeleteWhat sharp eyes you have! It seems I have intuitively just use SPDR STI ETF (I own them) instead of NIKKO STI ETF. Apologies for that. I have added another tab to differentiate between the two.

Monthly purchase price would definitely be different because I simply used the last close price for the month from Yahoo. On the other hand, POSB has a different way to compute the price which is stated on their FAQ:

"What will be the purchase price of the ETF that I have invested through POSB Invest-Saver?

Your purchase price would be based on the average subscription price on the Business Day following the day your account is debited, or such other day determined by the Bank in good faith and in a commercially reasonable manner.

The average subscription price is calculated by dividing the total cost of purchasing the units of the respective ETF by the total quantity of units purchased on that day by the Bank for the respective ETF. All customers will be provided with the same average subscription price."

It seems that the return from NIKKO STI ETF is slightly lower at 4.553% but still much higher as compared to ILP :)

Hi KPO,

ReplyDeleteI was just thinking of doing a post regarding the insurance that I have and what to do with it when I saw this post of yours.. Maybe you can give your inputs when its out!

In short, I'm thinking of cancelling it (its not a ILP but a limited payment life plan for 15 years which I've paid 2 years..), it was bought before I was 'enlightened'.. haha!

Hi Wife Say I Niao,

DeleteHaha. I guess people will generally go through that stage (before enlightenment). Sure, I will be happy to do that. You can just email me directly :)

How I would go about evaluating the plan is to compute the annualized guaranteed return and see what would be the opportunity cost. Most of the time, one will see that the annualized return can be easily achieved or even outperformed by investing yourself - getting market return (essentially any index e.g. STI ETF including dividends).

At the end, it will be the painful decision to make, should/would one let it go at a loss? This is always the hardest.

Hi KPO,

ReplyDeleteThanks! I'll see if I can run some numbers and maybe drop you an email (I"m not very good at them so will definitely appreciate the help!)

Yes, very painful decision to make!