Let me start by saying that this is not a sponsored post but from our experience.

It was just another typical day at work (2 weeks back) when I suddenly received an email from Michele Ferrario inviting us out for a lunch/coffee. Turns out he has read both of my articles on StashAway and wanted to discuss further. He was very sincere and even offered to travel near our workplace to make things easier for us. CZM and I were laughing at the email when he addressed CZM as "Zui Mao". lol. The thoughts of meeting him were quite daunting (we are just some random bloggers in the lowest level of the corporate ladder who have not even met our own CEO in person) but we still agreed to it.

These are the 2 articles:

- Introduction to StashAway - Robo-Advisor/Automated Investing

- Who has the lowest fees? StashAway vs Smartly vs AutoWealth

After some emails to and fro, we settled on a day where CZM and I happened to have taken leave to celebrate our 9th year anniversary at JAAN to visit the StashAway's office! (不好意思 - shy shy to let CEO travel to meet us. lol) Save me the trouble of planning what to do on our anniversary date too. Hahahaha.

One of the most common questions I get when discussing this with my friends is what happens in the event StashAway closes/goes bankrupt?

Although this was already stated in their FAQ, I decided to ask Michele the same question. His response was much longer than the above but you can be sure that your money will remain intact. The Capital Market Services License for Retail Fund Management awarded by MAS to StashAway has a minimum Base Capital Requirement of S$1,000,000. In the event, StashAway is not making any profit and has to close, that $1,000,000 will keep the company operational till it returns all of the customers' capital/investment. Depending on the circumstances, the customers will be offered to either liquidate all the shares and get their monies back or choose to keep the shares. In the latter case, StashAway would assist to open the relevant account with their partners and transfer those shares over.

It was just another typical day at work (2 weeks back) when I suddenly received an email from Michele Ferrario inviting us out for a lunch/coffee. Turns out he has read both of my articles on StashAway and wanted to discuss further. He was very sincere and even offered to travel near our workplace to make things easier for us. CZM and I were laughing at the email when he addressed CZM as "Zui Mao". lol. The thoughts of meeting him were quite daunting (we are just some random bloggers in the lowest level of the corporate ladder who have not even met our own CEO in person) but we still agreed to it.

These are the 2 articles:

- Introduction to StashAway - Robo-Advisor/Automated Investing

- Who has the lowest fees? StashAway vs Smartly vs AutoWealth

After some emails to and fro, we settled on a day where CZM and I happened to have taken leave to celebrate our 9th year anniversary at JAAN to visit the StashAway's office! (不好意思 - shy shy to let CEO travel to meet us. lol) Save me the trouble of planning what to do on our anniversary date too. Hahahaha.

During our 1 hour long meeting, we discussed various stuff but I shall not go into the details. It was quite entertaining when Michele got rather agitated while sharing his own experience - how he (CEO of Zalora then) was sitting on cash and ended up buying unit trusts sold by the bank. He then addressed some of the feedback I wrote in my articles and explained the rationale to us which I thought I should share it with the readers as well.

In my first article, I showed the 28 different risk levels and mentioned how it was an overkilled.

Turns out there is a very good reason for these 28 levels which was not evident/explained during the selection of the risk profile or in their FAQ. The exact words from Michele are that each portfolio targets a different risk level, measured with R-VaR (Regime Value at Risk). You

can read about VaR in Investopedia as I will only confuse you if I were to explain it or you can search for Regime Value at Risk which will return you a bunch of scholarly articles. In short, a level 1 risk means that one would have a 1% chance of losing up to 6.5% of your capital in a given year while a level 28 risk would have a 1% chance of losing up to 20% of your capital (R-VaR increase by 0.5% for every risk level). I was told that a basket of investment grade bonds has a VaR of approximately 14% so one could argue that StashAway’s portfolios are not very aggressive.

can read about VaR in Investopedia as I will only confuse you if I were to explain it or you can search for Regime Value at Risk which will return you a bunch of scholarly articles. In short, a level 1 risk means that one would have a 1% chance of losing up to 6.5% of your capital in a given year while a level 28 risk would have a 1% chance of losing up to 20% of your capital (R-VaR increase by 0.5% for every risk level). I was told that a basket of investment grade bonds has a VaR of approximately 14% so one could argue that StashAway’s portfolios are not very aggressive.

If you were to look at the goal projection, a smaller risk profile would have a smaller variance resulting in a smaller lower and upper bound while a higher risk profile would have a wider/larger lower and upper bound. The example below is based on a $500 monthly deposit.

Apart from the "General Investing" goal, there are 3 other goals that can be selected:

1. Plan for retirement

2. Buy a home

3. Pay for your child's education

(Michele tells me more goals are about to come!)

I was told that based on the selected goal and the input provided, it will automatically assign one of the 28 risk levels to you with the flexibility of adjusting it by +/- 4 risk levels. The assigned risk level has a 70% chance of hitting your target by the specified time frame as compared to the classic way of targeting a 50% chance. Unfortunately, I was not able to find the above information explicitly written/documented anywhere on the site so you will have to takemy word Michele's word for it.

|

| Risk Level 1 - Smaller Lower and Upper Bound |

|

| Risk Level 28 - Wider Lower and Upper Bound |

1. Plan for retirement

2. Buy a home

3. Pay for your child's education

(Michele tells me more goals are about to come!)

I was told that based on the selected goal and the input provided, it will automatically assign one of the 28 risk levels to you with the flexibility of adjusting it by +/- 4 risk levels. The assigned risk level has a 70% chance of hitting your target by the specified time frame as compared to the classic way of targeting a 50% chance. Unfortunately, I was not able to find the above information explicitly written/documented anywhere on the site so you will have to take

One of the most common questions I get when discussing this with my friends is what happens in the event StashAway closes/goes bankrupt?

Although this was already stated in their FAQ, I decided to ask Michele the same question. His response was much longer than the above but you can be sure that your money will remain intact. The Capital Market Services License for Retail Fund Management awarded by MAS to StashAway has a minimum Base Capital Requirement of S$1,000,000. In the event, StashAway is not making any profit and has to close, that $1,000,000 will keep the company operational till it returns all of the customers' capital/investment. Depending on the circumstances, the customers will be offered to either liquidate all the shares and get their monies back or choose to keep the shares. In the latter case, StashAway would assist to open the relevant account with their partners and transfer those shares over.

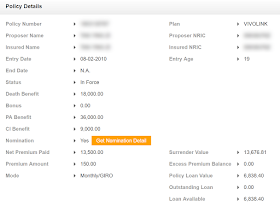

How often would you find an insurance agent buying the insurance/ILP he/she is selling? It is different for Michele who believes in the platform/product he is building. He himself is a customer of StashAway with a significant sum of money in it. Seeing is believing, he showed us his account during parts of our discussion. lol.

At the end of the meeting, we just had to ask for a wefie with Michele!

Anyway, if you are interested in finding out more, you can check out some of the sessions StashAway is holding from Eventbrite, meet the co-founders in person including Michele and listen to what they have to say. KPO and CZM will be attending one of it too!

StashAway Referral Link for Our Readers

Here you go: KPO and CZM Referral Link

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

At the end of the meeting, we just had to ask for a wefie with Michele!

Anyway, if you are interested in finding out more, you can check out some of the sessions StashAway is holding from Eventbrite, meet the co-founders in person including Michele and listen to what they have to say. KPO and CZM will be attending one of it too!

StashAway Referral Link for Our Readers

Here you go: KPO and CZM Referral Link

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)