This is a long overdue post! February passed by so quickly (our first CNY as husband and wife + fell damn sick) and we just came back from our Mini-Moon in Bali (3 days 2 nights) last weekend. After this, there is still our expenses report and it is taking me a much longer time because I am trying to track CZM's expenses too. Hahahaha.

Our monthly update will be different because of our new strategy - New Strategy: StashAway + Supplementary Retirement Scheme (SRS) and we have 3 portfolios now:

KPO and CZM Cash - StashAway Risk Index 20%

Our monthly update will be different because of our new strategy - New Strategy: StashAway + Supplementary Retirement Scheme (SRS) and we have 3 portfolios now:

KPO and CZM Cash - StashAway Risk Index 20%

KPO SRS - StashAway Risk Index 13%

CZM SRS - StashAway Risk Index 13%

1. PORTFOLIO SUMMARY (as of the last day of the month)

As of 5 March 2019, the market has recovered quite significantly!

KPO: $362.30 (+4.7% - Capital: $16,500)

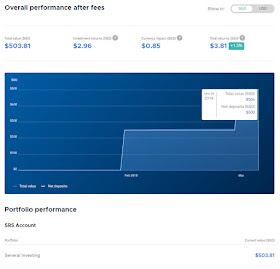

CZM: $3.81 (+1.3% - Capital: $250)

2. PORTFOLIO DETAILS

Note that these are reported in USD.

Notice how my SRS account (Can See No Touch) and CZM's SRS account (General Investing) is exactly the same? That is because we invested the money on the same date, got the same amount of USD as it was converted on the same day and bought the same number of stocks because the risk index of our portfolio is the same.

3. TRANSACTIONS

Notice how the StashAway first converted SGD to USD and then USD back to SGD on the same day? I thought this was pretty ridiculous, emailed their support and was given a template response.

However, one month later (in February statement), I saw the same thing happening! Anyway, long story short, I contacted the CEO, Michele and after a few email exchanges, I was told that this "inefficiency in the FX conversion logic" has been fixed. I will be monitoring it in March!

KPO and CZM Cash - StashAway Risk Index 20%:

SGD $495.00 converted to USD $365.25

Exchange Rate: 1.3552 (1.3813 last month)

USD $3.95 converted to SGD $5.34

Exchange Rate: 1.3519

This "inefficiency" caused $0.01318 (3.95 * (495.00 / 365.25) - 5.34 = $0.01318) to disappear into thin air just like that. It may be a small amount but as the portfolio gets larger, it will all add up.

4. FEE CALCULATIONS

The fee stated is based on the monthly-average assets SGD $15,113.30 x 0.8% / 365 days * 31 days = $10.27. Our fee should drop next month because I referred CZM!

No fee for CZM for the first 6 months.

StashAway VS STI ETF

Since there is no way to compare the performances among the robo-advisors, I came out with a spreadsheet to track our StashAway portfolio performance (General Investing - Risk Level 28) against that of STI ETF which I will be updating on a monthly basis. For simplicity, I shall assume that one can either invest in Nikko STI ETF using POSB Invest-Saver or invest in Nikko STI ETF/SPDR STI ETF using SCB Priority Online Trading (no minimum commission). These would be the opportunity costs while we continue to invest in StashAway.

Apart from the absolute P&L, we should also look at the Reward-to-Risk Ratio where risk/volatility is taken into account. For more information, do read StashAway Clarifications - Reward-to-Risk Ratio. StashAway has the highest ratio of 1.25 which is significantly higher than the other 2 STI ETFs (< 0.4). Let me quote Freddy Lim (Co-Founder & Chief Investment Officer of StashAway), "for every dollar of risk taken, StashAway P28 is producing 1.25 times the return".

This is updated till 8th March 2019 and is based on only 1 of our portfolio - KPO and CZM Cash - StashAway Risk Index 20%.

This month commentary:

Interestingly, StashAway is the only one in green but we can also see the total fee increasing significantly (it was 0.49% last month). Going forward it will be even more interesting when the commissions/fees incurred by StashAway exceed that of POSB Invest-Saver. This will be a battle between cheaper/lesser fees and asset allocation/diversification...

Looking at the time-weighted return, we can see that StashAway is "outperforming" the STI ETF (both excluding fees). In addition, it has lower volatility and max drawdown.

Which is the best? Only time will tell :)

This is the link to our spreadsheet - KPO & CZM StashAway Portfolio VS STI ETF which I have also added to Our Portfolio page.

StashAway Referral Link for Our Readers

Here you go: KPO and CZM Referral Link

You might be interested in previous months update too:

StashAway - December 2018

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

1. PORTFOLIO SUMMARY (as of the last day of the month)

|

| KPO |

|

| CZM |

As of 5 March 2019, the market has recovered quite significantly!

KPO: $362.30 (+4.7% - Capital: $16,500)

CZM: $3.81 (+1.3% - Capital: $250)

2. PORTFOLIO DETAILS

Note that these are reported in USD.

|

| KPO and CZM Cash - StashAway Risk Index 20% |

|

| KPO SRS - StashAway Risk Index 13% |

|

| CZM SRS - StashAway Risk Index 13% |

Notice how my SRS account (Can See No Touch) and CZM's SRS account (General Investing) is exactly the same? That is because we invested the money on the same date, got the same amount of USD as it was converted on the same day and bought the same number of stocks because the risk index of our portfolio is the same.

3. TRANSACTIONS

Will not be showing the transactions section going forward because there are too many to screenshot!

Notice how the StashAway first converted SGD to USD and then USD back to SGD on the same day? I thought this was pretty ridiculous, emailed their support and was given a template response.

However, one month later (in February statement), I saw the same thing happening! Anyway, long story short, I contacted the CEO, Michele and after a few email exchanges, I was told that this "inefficiency in the FX conversion logic" has been fixed. I will be monitoring it in March!

KPO and CZM Cash - StashAway Risk Index 20%:

SGD $495.00 converted to USD $365.25

Exchange Rate: 1.3552 (1.3813 last month)

USD $3.95 converted to SGD $5.34

Exchange Rate: 1.3519

This "inefficiency" caused $0.01318 (3.95 * (495.00 / 365.25) - 5.34 = $0.01318) to disappear into thin air just like that. It may be a small amount but as the portfolio gets larger, it will all add up.

KPO SRS - StashAway Risk Index 13%:

SGD $247.50 converted to USD $183.02

Exchange Rate: 1.3523

SGD $247.50 converted to USD $183.02

Exchange Rate: 1.3523

CZM SRS - StashAway Risk Index 13%:

SGD $247.50 converted to USD $183.02

Exchange Rate: 1.3523

SGD $247.50 converted to USD $183.02

Exchange Rate: 1.3523

4. FEE CALCULATIONS

|

| KPO |

|

| CZM |

StashAway VS STI ETF

Since there is no way to compare the performances among the robo-advisors, I came out with a spreadsheet to track our StashAway portfolio performance (General Investing - Risk Level 28) against that of STI ETF which I will be updating on a monthly basis. For simplicity, I shall assume that one can either invest in Nikko STI ETF using POSB Invest-Saver or invest in Nikko STI ETF/SPDR STI ETF using SCB Priority Online Trading (no minimum commission). These would be the opportunity costs while we continue to invest in StashAway.

Apart from the absolute P&L, we should also look at the Reward-to-Risk Ratio where risk/volatility is taken into account. For more information, do read StashAway Clarifications - Reward-to-Risk Ratio. StashAway has the highest ratio of 1.25 which is significantly higher than the other 2 STI ETFs (< 0.4). Let me quote Freddy Lim (Co-Founder & Chief Investment Officer of StashAway), "for every dollar of risk taken, StashAway P28 is producing 1.25 times the return".

This is updated till 8th March 2019 and is based on only 1 of our portfolio - KPO and CZM Cash - StashAway Risk Index 20%.

This month commentary:

Interestingly, StashAway is the only one in green but we can also see the total fee increasing significantly (it was 0.49% last month). Going forward it will be even more interesting when the commissions/fees incurred by StashAway exceed that of POSB Invest-Saver. This will be a battle between cheaper/lesser fees and asset allocation/diversification...

StocksCafe

Looking at the time-weighted return, we can see that StashAway is "outperforming" the STI ETF (both excluding fees). In addition, it has lower volatility and max drawdown.

Which is the best? Only time will tell :)

This is the link to our spreadsheet - KPO & CZM StashAway Portfolio VS STI ETF which I have also added to Our Portfolio page.

StashAway Referral Link for Our Readers

Here you go: KPO and CZM Referral Link

You might be interested in previous months update too:

StashAway - December 2018

Do like any of the following for the latest update/post!

1. FB Page - KPO and CZM

2. Twitter - KPO and CZM

3. Click here to subscribe using email :)

4. Instagram - KPO_and_CZM (Did you see those delicious food photos to the right --> Unfortunately, you can't see it on mobile.)

No comments:

Post a Comment