KPO recently met up with a group of friends. We are all working for different companies now and 1 of them works in SGX. I laughed at him claiming that he is one of the directors for those companies cause I have seen him appearing at IPO events, taking photos, etc on the SGX FB page - SGX | My Gateway. He then made an interesting comment stating that all IPO will make money (sell on the opening day). How true is it?

KPO went to SGX website and found a page where past performances of the IPOs are being tracked! Unfortunately, SGX only provides data for the last 3 years, hence that limits my analysis (it would have been great if we can see how did IPOs perform during the financial crisis). I spent some time to clean up the data and present to you the following tables and conclusion which I found it to be quite interesting:

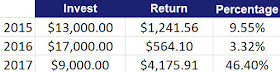

At one glance you can see more green color which represents a positive return if you were to sell at/near the closing price. Assuming if I were to invest $1,000 in each IPO and sell it on the first day, I would indeed be sitting on a huge profit!

That is a simple calculation of return for 1 day, the annualized return will be ridiculous! The total return is a +20.25% gain ($7,895.57 from $39,000). 2017 has a much higher return because it has lesser number of IPOs year till date. Furthermore, we are in a bull market where 100% of the IPOs closed higher than offer price! Will the same happen for the upcoming Netlink Trust? xD

Now let's assume that I invest in $1,000 in each IPO, forget about them and hold until today, what would be my return? I should make more money right??

OMG! This kind of results will get caned by my mother one! So many failed subjects, all red red >.<

The total return is +15.38% ($5,981.57 from $39,000) after 3 years. The above calculations are simplified as dividends are not taken into account. If you looked carefully, the returns are positive due to exceptional huge return by a few stocks.

For example:

2015 IPOs - Jumbo returns 152% while Singapore O&G return 460% till date!

2016 IPOs - Acromec returns 57% and HC Surgical returns 57%!

Moral of the article: Buy/Participate in all the IPOs and sell on its opening day! Trust the guy working in SGX! Just kidding, do note that past performance is not a good indication of how the future performance will be. The above strategy will only work IF you can participate in all IPO but the chances of getting it seem so low that you have a higher chance applying for BTO.

The pictures might be quite small and if you are interested in looking at the raw data. You can refer to this link - IPO Analysis. (The formulas are in my Excel spreadsheet but sharing that may reveal my identity so please make do with the google spreadsheet. lol)

Hope you guys enjoy this! On a side note, I have changed the blog name and URL to include CZM since she *might* be coming back.

KPO went to SGX website and found a page where past performances of the IPOs are being tracked! Unfortunately, SGX only provides data for the last 3 years, hence that limits my analysis (it would have been great if we can see how did IPOs perform during the financial crisis). I spent some time to clean up the data and present to you the following tables and conclusion which I found it to be quite interesting:

At one glance you can see more green color which represents a positive return if you were to sell at/near the closing price. Assuming if I were to invest $1,000 in each IPO and sell it on the first day, I would indeed be sitting on a huge profit!

That is a simple calculation of return for 1 day, the annualized return will be ridiculous! The total return is a +20.25% gain ($7,895.57 from $39,000). 2017 has a much higher return because it has lesser number of IPOs year till date. Furthermore, we are in a bull market where 100% of the IPOs closed higher than offer price! Will the same happen for the upcoming Netlink Trust? xD

Now let's assume that I invest in $1,000 in each IPO, forget about them and hold until today, what would be my return? I should make more money right??

OMG! This kind of results will get caned by my mother one! So many failed subjects, all red red >.<

The total return is +15.38% ($5,981.57 from $39,000) after 3 years. The above calculations are simplified as dividends are not taken into account. If you looked carefully, the returns are positive due to exceptional huge return by a few stocks.

For example:

2015 IPOs - Jumbo returns 152% while Singapore O&G return 460% till date!

2016 IPOs - Acromec returns 57% and HC Surgical returns 57%!

Moral of the article: Buy/Participate in all the IPOs and sell on its opening day! Trust the guy working in SGX! Just kidding, do note that past performance is not a good indication of how the future performance will be. The above strategy will only work IF you can participate in all IPO but the chances of getting it seem so low that you have a higher chance applying for BTO.

The pictures might be quite small and if you are interested in looking at the raw data. You can refer to this link - IPO Analysis. (The formulas are in my Excel spreadsheet but sharing that may reveal my identity so please make do with the google spreadsheet. lol)

Hope you guys enjoy this! On a side note, I have changed the blog name and URL to include CZM since she *might* be coming back.

No comments:

Post a Comment